With Russia becoming increasingly closed off to the financial world following its invasion of Ukraine, it appears Russian investors are becoming increasingly active in the cryptocurrency market.

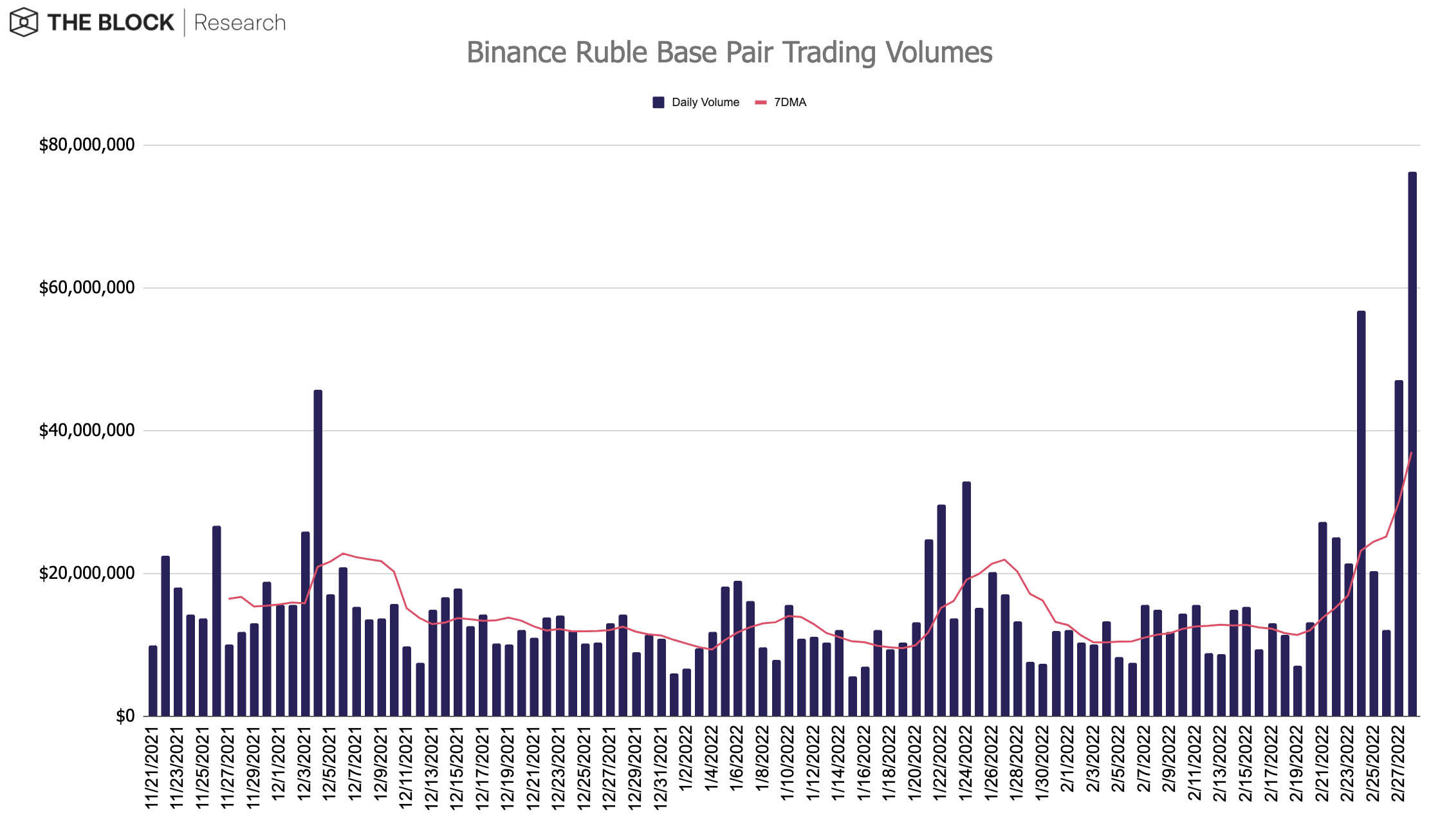

Since Russia staged its invasion, average volumes of ruble pairs on crypto exchange Binance have surged, increasing to an average of $35.8 million per day compared to $11 million per day before the invasion began. The heightened activity represents one of the few places where Russians can move rubles.

“Exchanges that allow onboarding of RUB pairs will see a huge demand, given that is almost the only way to get out of RUB for many (banks shut down fx facilities),” one exchange executive told The Block.

The backdrop of this action is a tightening of access to financial markets, perhaps best signified by moves to restrict some Russian banks from the SWIFT payment messaging network and efforts to block Russia’s central bank from accessing foreign assets. Economic sanctions have served as the primary retaliation vehicle against Russia’s invasion of Ukraine, which continues to intensify.

Yet crypto exchanges offer a kind of oasis from the financial restrictions. Exchange operators, including Binance and Coinbase, have rebuffed requests from Ukraine’s government to commit to blanket bans of Russian users.

The impact on Russian markets has been significant, with the VanEck Russian ETF losing more than 60% of its value in February. This week, the ruble cratered to below one penny as sanctions roil its markets. Russia’s central bank also moved to close the Moscow Stock Exchange and sharply raised interest rates.

Market observers who spoke with The Block pointed to signs that crypto is serving as somewhat of an escape hatch, though the full extent of this activity remains uncertain.

“There is evidence of increased BTC demand,” said Michael Safai, a partner at Dexterity Capital, who added:

“BTC is outperforming ETH atm, and BTC dominance is at a high, which aligns with the proposition that there is increased demand for capital flight.”

Elsewhere, Konstantin Shulga, co-founder of Finery Markets, told The Block that “we don’t deal with any Russian counterparties, but i assume the demand is quite big.”

Still, trading could wane if Binance’s ruble on-ramps are disrupted.

As noted by The Block Research’s Larry Cermak, Binance is using two payment providers — Simplex and Mercuryo — for ruble onboarding. If those relationships are disrupted, then Russians could only trade with other fiat currencies or trade crypto-to-crypto pairs.

“Once they stop working, it’s over,” Cermak said in a message.

theblockcrypto