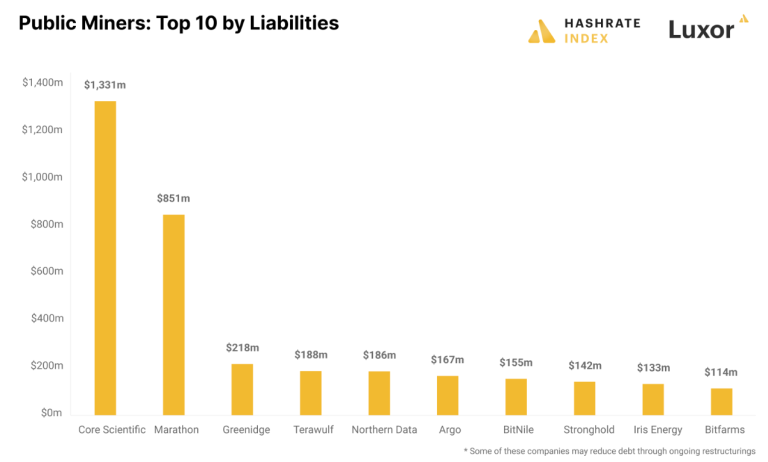

The mining industry for Bitcoins incurred a sizeable debt load during the bull market of 2021, which hurt their financial health during the subsequent bear market. The top 10 cryptocurrency mining debtors together owe more than $2.6 billion, according to predictive analytics by Hashrate Index.

Due to declining sales and BTC prices, Core Scientific, the largest debtor in the group with $1.3 bn in obligations on its income statement as of September 30th, has filed for Chapter 11 insolvency protection in Texas. The majority of convertible note liabilities totalling $851 million belong to Marathon, the second-largest debtor. By enabling the debtors to exchange the convertible notes for stock, Marathon avoids bankruptcy.

To pay off debt, the majority of Bitcoin miners, including Greenidge, the third-largest debtor, are undergoing a restructuring process. The debt-to-equity relation of publicly traded bitcoin mining businesses suggests a substantial risk for the sector.

The Combined Debt of Public Bitcoin Mining Firms is $4 Billion

According to the Hashrate Index, most sectors see a debt-to-equity proportion of 2 or greater as dangerous. The graph below demonstrates the unusually high debt-to-equity ratios that some of the more well-known Bitcoin miners presently wear. The mining industry may experience possible restructurings as well as bankruptcy proceedings unless the bulls stage a return, given that more than 50% of the 25 publicly traded bitcoin miners flaunt exceptionally high debt-to-equity ratios.

While some businesses may halt or scale back operations to cut costs, this will enable sustainable miners to increase their footprint by purchasing the facilities and equipment of rival enterprises.

On December 20, Greenidge and the Bitcoin-focused financial company NYDIG agreed to restructure $74 million in debt.

2.8 exahashes per second (EH/s) or more worth of mining capacity would be acquired under the terms of the NYDIG agreement, according to Cointelegraph. The mining corporation would get a debt reduction ranging from $57M to $68M in return.

More information on Bitcoin Mining

Bitcoin is the first decentralized digital currency that uses the underlying blockchain technology to allow peer-to-peer transfers without the use of any middlemen like banks, organizations, agents, or brokers. No matter where they are, anyone on the network can send bitcoins to another user on the network; all they need to do is create a profile on the network, deposit some Bitcoins into it, and they’ll be able to send the bitcoins.

A global network of computers that run the Bitcoin code is used in the process of “mining” bitcoins to verify payments and upload them to the Blockchain network correctly. The mining process also produces new Bitcoins.

By mining Bitcoins, which involves comparing new transactions with the Bitcoin network, new coins are created. The procedure of participating and electronically verifying Bitcoin transactions on the blockchain is termed “mining.” Difficult cryptographic hash problems must be resolved to validate changed transaction blocks on the decentralized blockchain ledger. The tools and processing power needed to solve these puzzles are cutting-edg