Bitcoin’s ascent will cost gold market share, according to a research report by investment banking giant Goldman Sachs.

In a note to clients dated January 4, the bank said that the market capitalization of the largest cryptocurrency will likely grow as “a byproduct of broader adoption of digital assets, and possibly due to Bitcoin-specific scaling solutions.”

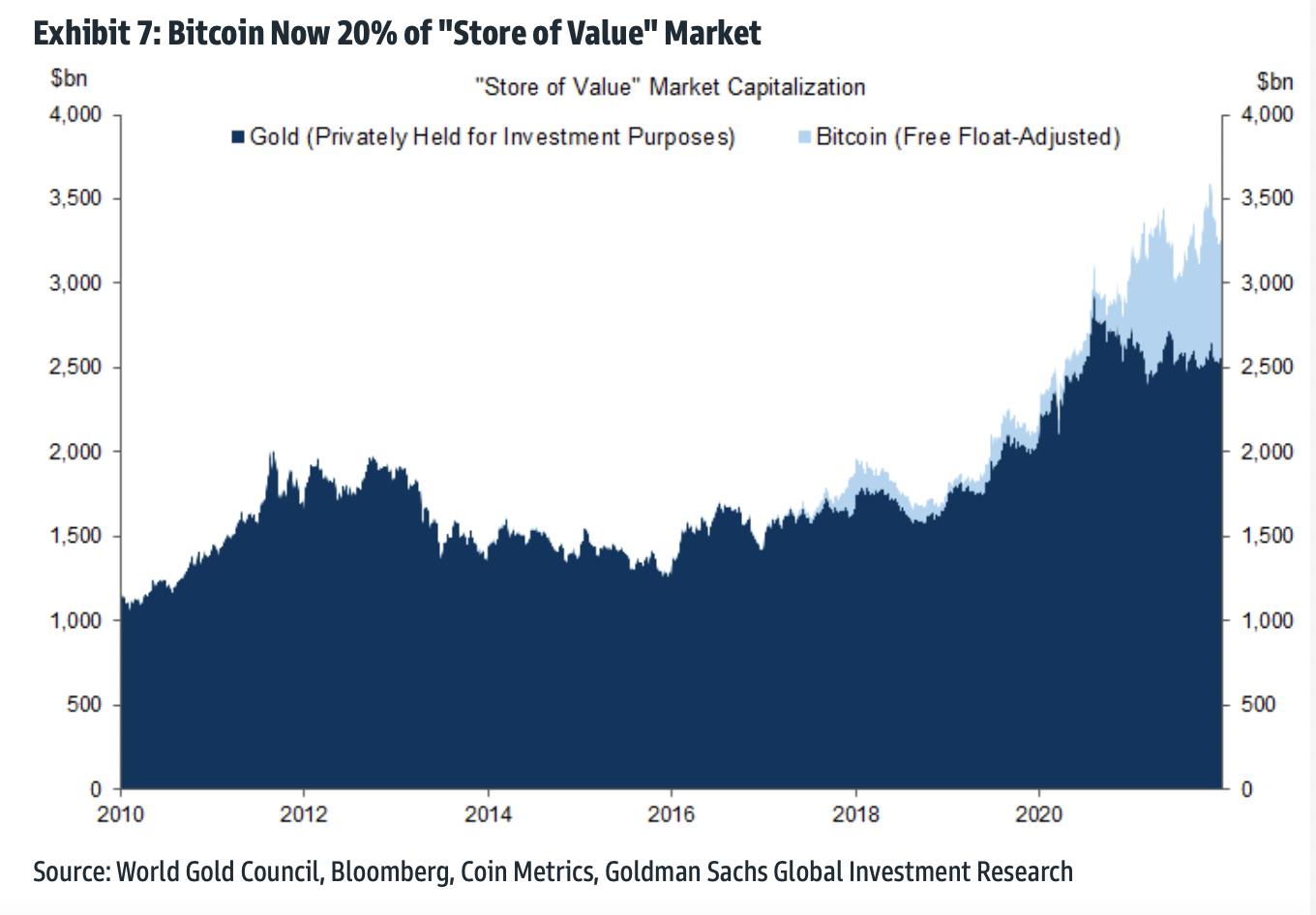

Looking at bitcoin’s float-adjusted market capitalization, the cryptocurrency accounts for about 20% of the total “store of value” market, which is currently dominated by gold. Proponents of bitcoin—ranging from Paul Tudor Jones to Anthony Scaramucci—have backed bitcoin as a store of value and inflation hedge asset akin to gold.

According to Goldman Sachs, the price of bitcoin could possibly increase to more than $100,000 if it were to command 50% of the so-called “store of value” market. The bank added that use-cases outside of store of value could serve as a tailwind for the crypto.

“Bitcoin may have applications beyond simply a “store of value”—and digital asset markets are much bigger than Bitcoin—but we think that comparing its market capitalization to gold can help put parameters on plausible outcomes for Bitcoin returns,” the bank said.

Goldman previously noted that bitcoin was among the best performing assets of the year in 2021, despite underperforming relative to other assets considering its volatility.

theblockcrypto