Recent research by Valuechain examined and compared the energy consumption of the traditional banking system with Bitcoin’s Proof of Work and Bitcoin Lightning mechanisms. Bitcoin blockchain technology often gets slammed in the media as consuming too much energy. However, the recent study reveals otherwise.

The research was conducted by Michael Khazzaka, who is an IT engineer and cryptographer. His research was published on April 20, and the discoveries are pretty shocking, for instance that “Bitcoin payments are a million times more efficient than traditional banking.”

Unexpected Figures in Efficiency & Scalability

As the abstract of the research paper says, the results of the study are based on physics and information science as well as economics. “We compute and compare the energy consumption and define what is the energy efficiency of both the current monetary system and Bitcoin crypto payment system.”

Apparently, a single Bitcoin (BTC) transaction on the PoW (Proof-of-Work) based blockchain is consuming up to five times less energy than an instant payment in the current monetary system. In addition, if the results of PoW and Bitcoin Lightning system were combined, it would mean the blockchain transfers are 56 times more efficient than Instant Payments. The researchers also note that if we’d compare Bitcoin Lightning system transactions to traditional banking payments alone, Bitcoin Lightning would outrun the traditional Instant Payments system by a million times.

Crypto Community Is in Search of Objectivity

The environmentally challenging crypto mining and PoW transactions have been widely discussed on social media; therefore big players in the crypto game such as Ethereum (ETH) decided to fully switch to the Proof of Stake (PoS) mechanism, which is 99% less energy-consuming.

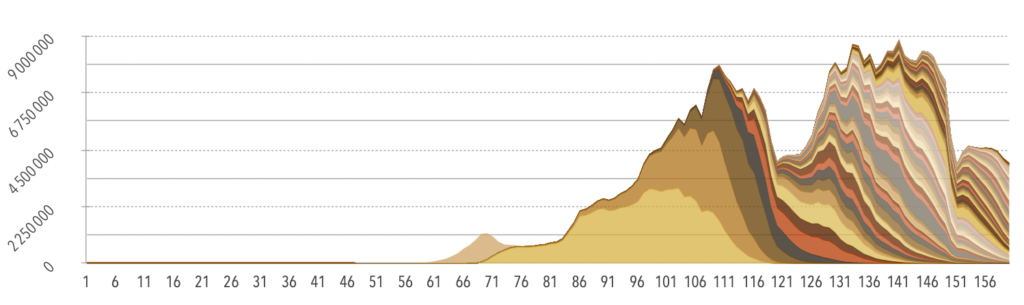

Previously, Cambridge’s Bitcoin Electricity Consumption Index indicated that Bitcoin consumes about 122 TWh. Khazzaka argues that’s not the case, as his graph shows an estimate of 88.95 TWh and points out that “Bitcoin is a great and very efficient technological solution that deserves to be adopted on a large scale. This invention is brilliant enough, efficient enough, and powerful enough to get mass adoption.” The question is, will the global leaders be courageous enough to adopt the technology?