Bitcoin Slumps to Below $48K Ahead of $6B Options Expiry

A total of 129,800 option contracts worth more than $6 billion are set to expire on Friday; ether’s price plummets.

Prices

Bitcoin (BTC): $47,701 -6.2%

Ether (ETH): $3,813 -5.7%

Markets

S&P 500: $4,786 -0.1%

DJIA: 36,398 +0.2%

Nasdaq: $15,781 -0.5%

Gold: $1,807 -0.2%

Market moves: Bitcoin slumps below $48,000, as December’s options expiration nears

Technician’s take (Editor’s note): Technician’s Take is taking a hiatus for the holidays. In its place, First Mover Asia is publishing CoinDesk reporter Sanadali Handagama’s interview with European Parliament member Eva Kaili. The discussion covered MiCA, the current regulatory frenzy over stablecoins, Web 3 and of course, Facebook’s Diem.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto industry leaders and analysis.

Prices

Bitcoin (BTC): $47,701 -6.2%

Ether (ETH): $3,813 -5.7%

Markets

S&P 500: $4,786 -0.1%

DJIA: 36,398 +0.2%

Nasdaq: $15,781 -0.5%

Gold: $1,807 -0.2%

Market moves

Bitcoin, the oldest cryptocurrency, dropped by more than 6% to under $48,000 during the U.S. trading day on Tuesday, despite continued muted spot market activities.

While the spot trading volume of bitcoin remained mostly unchanged from a day ago, its price turbulence came as the market headed into monthly options expiration.

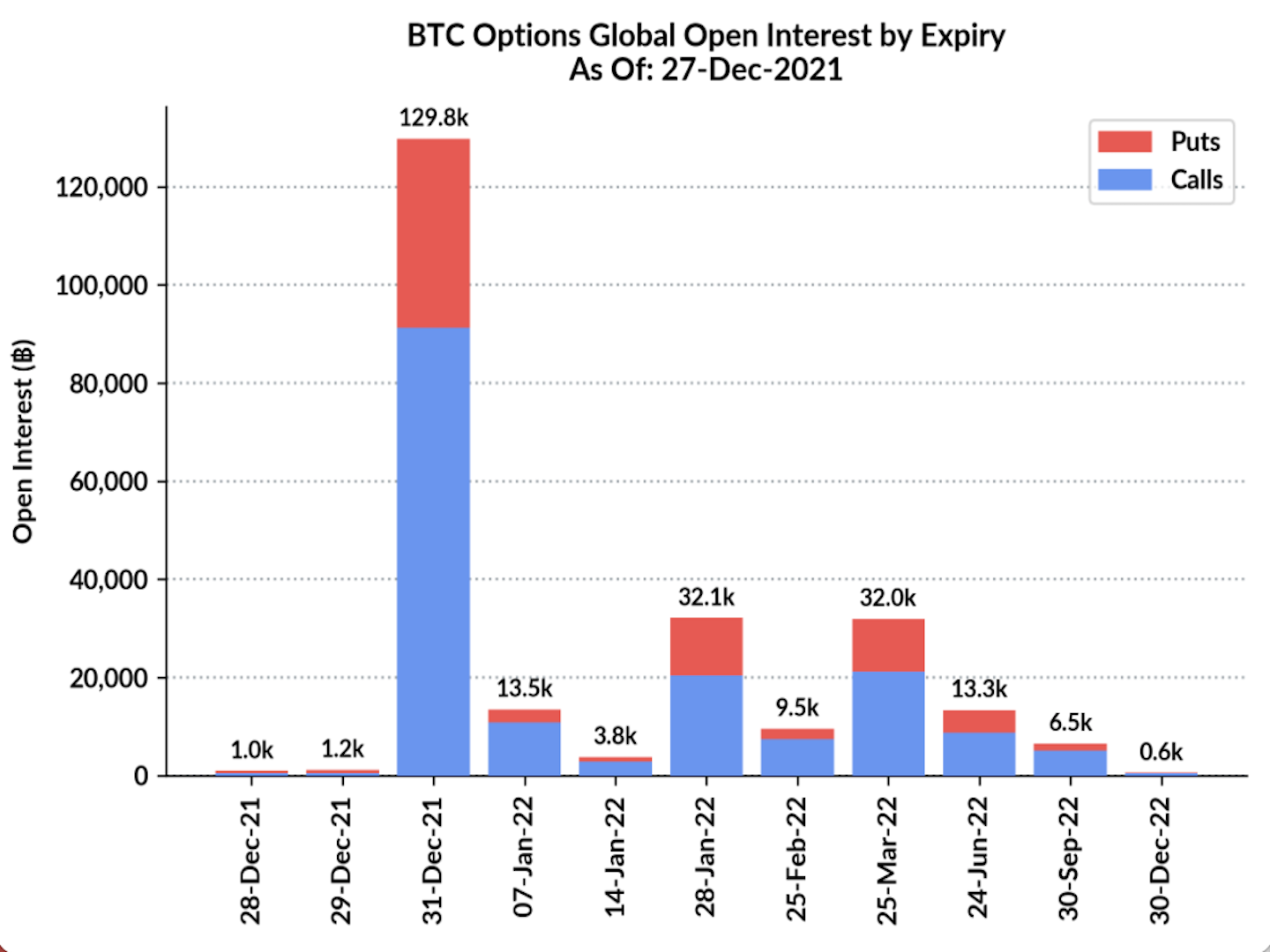

A total of 129,800 option contracts worth more than $6 billion are set to expire on Friday, according to data provided by Skew. As CoinDesk reported previously, data shows that bitcoin tends to move toward the “max pain” point in the lead-up to an expiration and sees a solid directional move in days after settlement.

This price move trend usually comes from spot market manipulations by option sellers (mostly institutional traders) to push the spot price closer to the strike price at which the highest number of open options contracts expire worthlessly. That creates maximum losses – so-called max pain – for option buyers. The max pain point for Friday’s option expiration is $48,000, according to Cayman Islands-based crypto financial services firm Blofin.

Q&A – Eva Kaili

The View From Brussels: How the EU Plans to Regulate Crypto: European Parliament member Eva Kaili says Facebook’s libra announcement in 2019 catalyzed lawmakers into action on digital assets. (By CoinDesk reporter Sandali Handagama)

The European Union (EU) wants to regulate the digital asset industry; there are a number of bloc-wide initiatives already underway. The most comprehensive is a 168-page “Markets in Crypto-Assets” (MiCA) that would create an EU-level licensing framework for crypto issuers and service providers.

But crypto regulations are only one part of a larger Web 3.0 governance strategy for the political and economic union of 27 nations.

According to Eva Kaili, a member of the European Parliament, the new proposals for digital assets, data and artificial intelligence (AI) were all inspired by the General Data Protection Regulation (GDPR) of 2016, which sought to strengthen consumers’ control over how their data is used by companies allowed to operate in the EU.

For digital assets in particular, the catalyst was Facebook’s 2019 plans to build its own stablecoin, libra (now diem), a digital token backed by a basket of currencies and assets, Kaili said. She added that regulatory clarity for digital finance is key to fostering innovation and protecting citizens freedom and sovereignty from being exploited by Big Tech.

Kaili is a Greek politician, a member of the Progressive Alliance of Socialists and Democrats in the European Parliament; she was elected in 2014. Kaili has advocated for innovation-friendly regulations for distributed ledger technology (DLT) applications and decentralized finance (DeFi).

coindesk