Crypto traders had a brief opportunity to pause and take stock of where things are on June 16 as the relentless selling that has hammered Bitcoin (BTC) and the wider market over the past week began to relent despite an ongoing sell-off in the traditional markets.

Data from Cointelegraph Markets Pro and TradingView shows that after climbing to a high of $23,000 in the early trading hours on June 16, the price of Bitcoin slowly trended down on diminished trading volume to hit a low at $20,765.

Here’s what several analysts in the market are saying about the outlook for Bitcoin moving forward as crypto traders try to determine if the bottom is in or if there is more downside ahead.

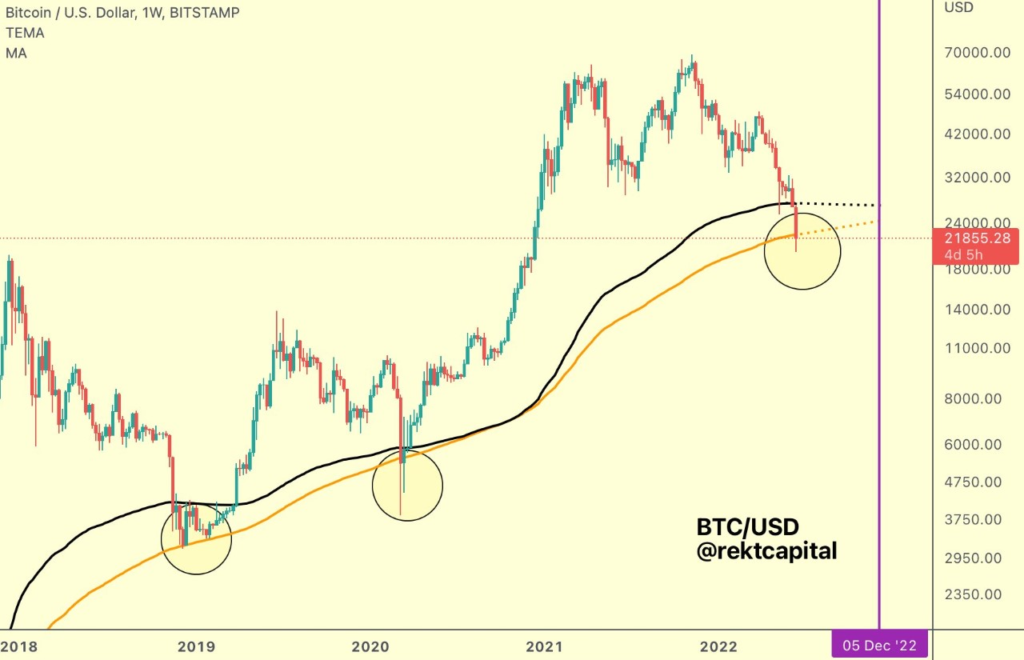

A macro perspective of the journey that Bitcoin has taken over the years and how its past can offer insight into the current market setup was discussed by analyst and pseudonymous Twitter user Rekt Capital, who posted the following chart highlighting BTC’s behavior near its 200-week moving average (MA).

Rekt Capital said,

“If #BTC continues to hold the orange 200-week MA as support and the black 200-week EMA figures as resistance… $BTC could form an Accumulation Range here, just like in 2018. This would enable multi-month consolidation to even as far as December 2022.”

If this is the scenario that plays out, then crypto traders need not rush to accumulate BTC, a point noted by crypto trader and pseudonymous Twitter user Altcoin Sherpa, who posted several charts highlighting the amount of time that BTC spent in previous accumulation phases.

The longest accumulation period noted by Altcoin Sherpa is the 287 day span outlined in the chart above. Other examples provided include the 133 days of accumulation between November 2018 and April 2019 and the 63 days of accumulation between May 2020 and July 2020.

Altcoin Sherap said,

“It’s likely that you will get plenty of time to catch a bottom during the accumulation phase. #Bitcoin takes a while for its bottom to form and you should probably just go out and touch some grass instead of knife catching.”

Bitcoin could reclaim $25,000, if we’re lucky

A more positive take on the latest developments for Bitcoin was offered by crypto trader Nebraskangooner, who provided the following chart noting that the “lower Fibonacci level has been reached.”

Nebraskangooner said,

“Let’s see if daily can close strong above resistance and then we have a chance for $25,000 and possibly mid $30K’s. For the first time in months we might finally be ready for the bounce everyone has been calling for since $40K.”

Related: Further downside is expected, but multiple data points suggest Bitcoin is undervalued