Fidelity Director of Global Macro- Jurrien Timmer recently showed three on-chain metrics indicating that Bitcoin is undervalued.

A few days ago in a post on Twitter, the director of Fidelity said that Bitcoin may be “cheaper than it looks.” The investment expert mentioned that the price of Bitcoin (BTC) compared to the digit of wallet addresses that are dealing with the token currently is compared to the year 2017, which was the time when the cryptocurrency entered its latest “winter season”.

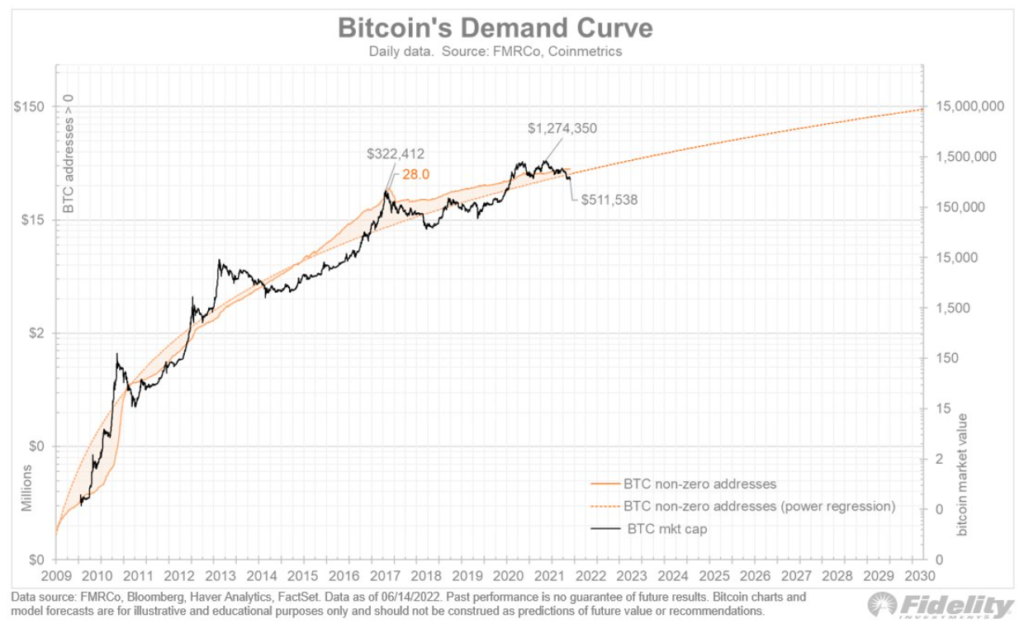

In that post, Timmer gave a distinct viewpoint which gives a similar conclusion. He states that the token value compared to the number of non-zero addresses that hold some Bitcoin (BTC) in it – is dealing less than the network’s predicted curve.

An analysis of some on-chain data metrics indicates that the real valuation of the coin can be higher than its current price. While Bitcoin has dropped to levels of 2020, its network price ratio has turned back to 2013 and 2017 levels, indicating that Bitcoin is undervalued.

f we understand from a statistical viewpoint, Bitcoin appears like a very high liability asset which doesn’t have strong medium or long-term movements to trend or revert. There is no perfect lucky path with the future approach separate from past price movements, but it is closer to one than other main assets.

Bitcoin has fallen by 50% since November. It is not an uncommon situation for a cryptocurrency; the situation was the same from April to July 2021 and quickly recovered. Talking about the past, buying Bitcoin when the price was dropping was equally tempting as buying it when it was increasing.

Why Bitcoin Is Undervalued?

The traditional stock market investors operated the network price ratio as a crypto-riff on a known metric called the price-to-earnings (P/E) ratio. With the help of the ratio, you can determine whether a stock is over or undervalued.

Charts posted by Timmer on Twitter

If a high ratio is determined, then it could suggest an asset is overvalued, and if a low ratio comes, it could be an undervalued asset.

Timmer also gave importance to a chart indicating Bitcoin’s demand curve covered with Bitcoin’s non-zero addresses against its market capitalization. With a note that the price is now dropping below the network curve.

Technically Bitcoin Is Oversold

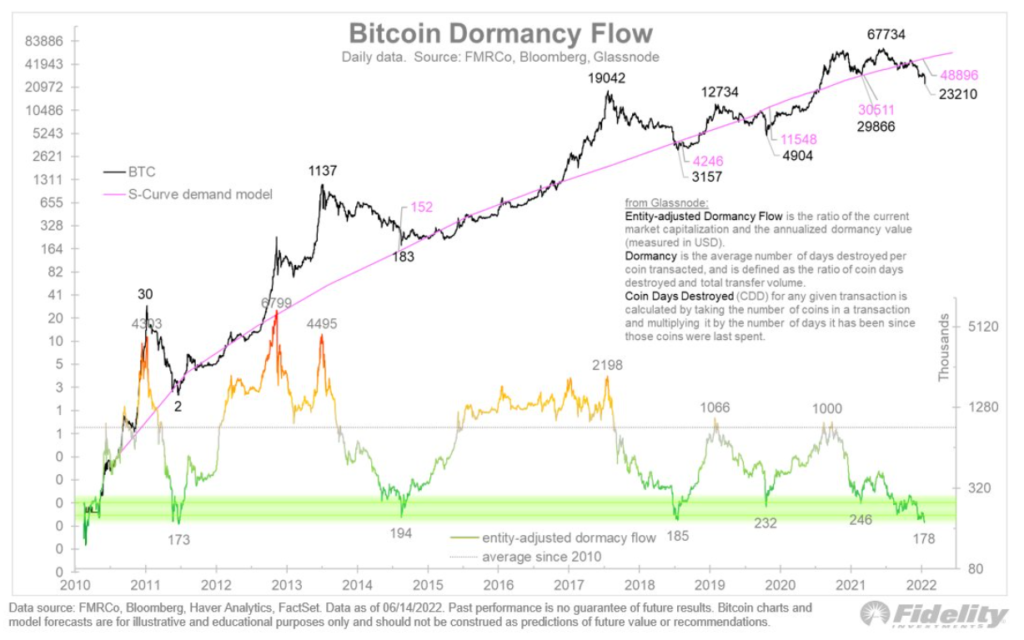

A popular metric, named Entity-adjusted Dormancy Flow, is used for considering Bitcoin value by comparing the price to spending behaviour. According to research done by Glassnode, a lower dormancy flow value can indicate raised long-term holder conviction; it means the long-term Bitcoin holders are purchasing from a bad short-term seller.

harts posted by Timmer on Twitter

The Digital co-founder and you tuber- Anthony Pompliano gave a similar opinion to Fox Business Monday. He explained that Bitcoin’s value and price are separated. Due to that, the weak sellers are selling to strong investors. This indicates that Bitcoin is getting oversold.

Predictions for Bitcoin for 2022 and Future

In the context of where Bitcoin might be reaching this year and beyond many analysts have shared their views. Scott Minerd, the chief investment officer for Guggenheim Investments, said that the digital asset will surely go down to the $8,000 level due to the Fed’s recent restrictive approach.

The billionaire investor Tim Draper also shared his opinion as he confirmed his forecast of $250,000 for Bitcoin by the end of 2022 or early 2023. Draper explains his prediction by saying that retailers haven’t figured out yet that they could at least save 2% on each transaction that is paid with a credit card by taking Bitcoin.