TL;DR Breakdown

- Many old Bitcoin mining machines are now closer to shutdown price as BTC dropped below $25,000.

- New Gens like Antminer S19 and Whatsminer M30 are still profitable.

- Overall, miners’ USD revenue has fallen almost 70% since October 2021.

The largest cryptocurrency, Bitcoin dropped below $25,000 on Binance earlier today, consequently affecting the profitability of miners still using older-generation Bitcoin mining rigs.

Less profit for old Bitcoin mining rigs

Two of the popular old Bitcoin mining machines, Antminer S11 and Avalon A9, could be going offline on the Bitcoin network as both are now mining near/at an unprofitability state, according to stats provided by f2pool. These machines are older models, and they operate with energy-intensive components but with lower mining efficiency compared to the new generation machines.

At the current rate, an Antminer S11 machine generates a $2.13 revenue from a $2.07 electricity cost, resulting in a meager profit of $0.06. Meanwhile, Avalon A9 mines at a complete loss. It would cost $2.48 in electricity bill to generate a lower $2.39 revenue at the current market rate.

Other Bitcoin mining machines operating at a loss include Holic H22, Antminer S9 SE, Avalon A911, Antminer S9, Aladdin L2, INNOSILICON T2T-25T, Avalon A921, Antminer S9i, and so on.

Miners’ revenue slumps

While the quantity of Bitcoin rewarded to miners per block produced remains the same, the USD value of the reward can vary depending on the market price of BTC at the time. Bitcoin further slid below $25,000 hours ago, resulting in the less-to-nothing profit for older Bitcoin mining machines. Newer models still mine at a profit, as they are more efficient and incur less electricity cost.

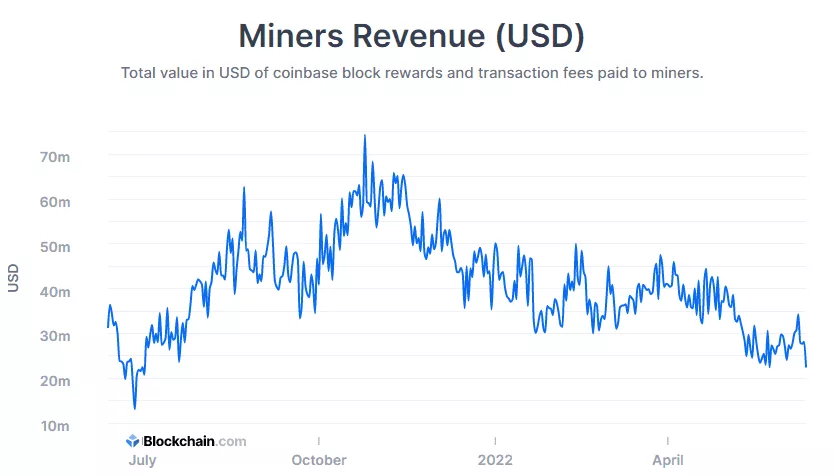

Antminer S19 and Whatsminer M30 are still profitable and far from shutdown price. However, the overall Bitcoin miners’ revenue (USD) has dropped significantly since October 2021, following the price of Bitcoin.

Since reaching a high of $74.4 million on October 10, 2021, the total USD value of coinbase block rewards and transaction fees paid to Bitcoin miners has dropped by nearly 70% to the current value of $22.57 million, according to information provided by Blockchain.com.

Regardless of the falling price of Bitcoin, the network hashrate has been increasing rapidly. BTC hashrate now sits at 231.428 million TH/s.