The price of Bitcoin has been on a massive decline over the past few months. The coin has shed more than two-thirds of its value since hitting an all-time high in November last year. Amid this fall, the prices of graphic cards, also known as GPUs, have also dropped, which is expected to help cryptocurrency miners offset operational costs amid the bear market.

Cost of mining GPUs decline

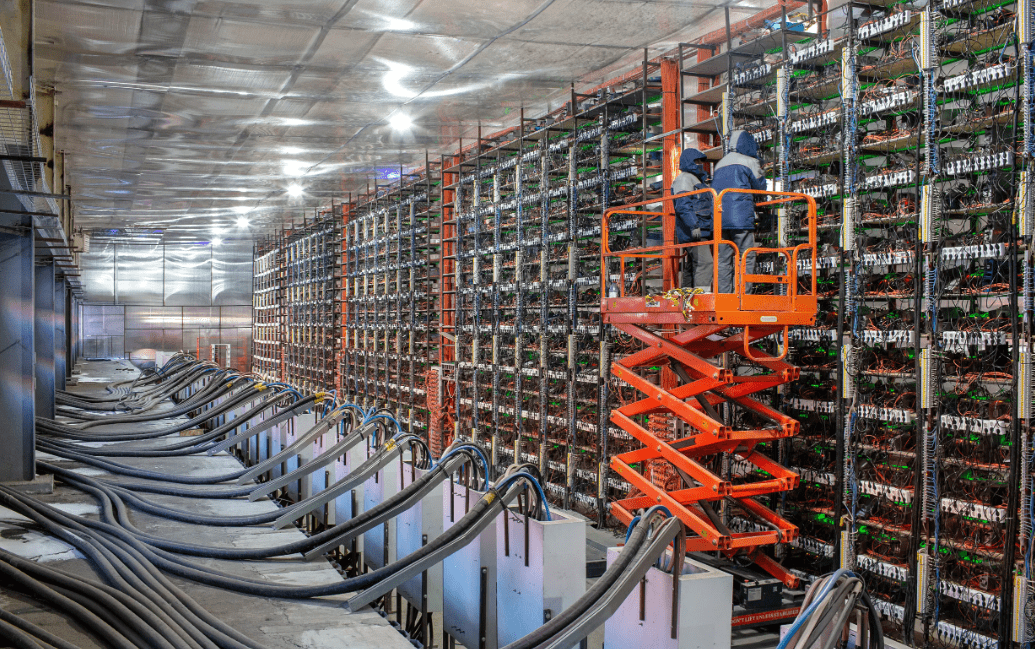

Bitcoin mining sites have recorded declined revenues of more than 79.6% during the past nine months. The Bitcoin mining revenues reached a record-high of $74.4 million on October 25 last year, when the market was in a strong bullish rally.

Despite the mining revenues hitting an ATH towards the end of last year, miners were still feeling the pinch of the increased prices of graphic processing units (GPUs) because of the supply chain disruption caused by the COVID-19 pandemic.

The supply chain is recovering globally, and card manufacturers have resumed their mining operations. This has caused a decline in the GPU prices, with the value of some cards now selling at below 15% of their previous prices. This dip comes as the supply recovers to now surpass the demand.

On the other hand, the increased supply of GPUs in the market has forced sellers in the secondary markets to lower the prices of used mining rigs. Some public Bitcoin miners have also become well-positioned to survive the current bear market, as they are still sustaining their mining operations despite the low revenues.

Some mining firms that have shown a strong performance amid the bear market include Argo, CleanSpark, Marathon, Stronghold, and Riot Blockchain. These companies have sustainable mining revenues to operational cost ratio.

Small miners buy mining equipment

The notable decline in GPU prices has allowed small mining companies to buy powerful, more efficient mining equipment. The mining hash rate has also declined significantly to 203.6 exa hashes per second, with miners now requiring less computing power to mine a block on the Bitcoin network.

While the mining revenues have dropped, some firms are not selling the newly mined coins. Marathon Digital Holdings announced it was stacking Bitcoin. The company announced that during the first quarter of 2021, it cost $6200 to produce one Bitcoin. The company also said that it had a fixed price for power and was not affected by changes in the energy market.