Anxieties about broader market conditions and the meltdown of TerraUSD (UST) have sent traders fleeing from the cryptocurrency space, triggering fears that the decline in prices in the nascent market could have a spillover impact on the US economy.

Those fears are overblown — at least, according to one research note sent out to clients by Goldman Sachs.

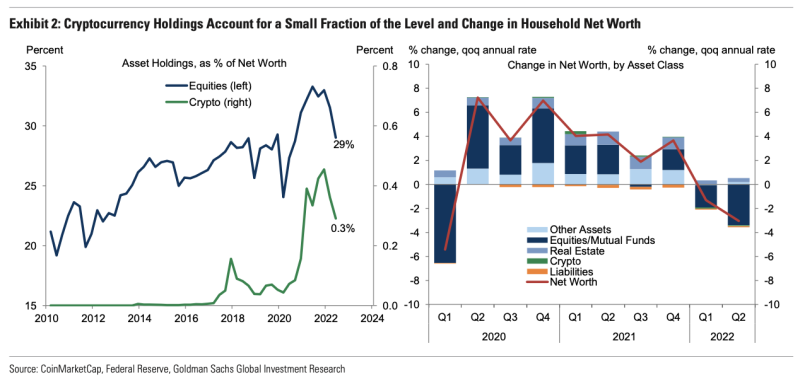

A group of the bank’s researchers, led by Joseph Briggs, said that any impact of the crypto markets slide on US spending should be very small since “the recent decline is very small relative to US household net worth.”

Bitcoin’s price is down more than 35% since the beginning of the year.

As per the bank, cryptocurrency holdings as a percentage of net worth represent a mere 0.3% of US household net worth compared to 29% for US equities.

According to the bank’s researchers:

“While there is admittedly a lot of uncertainty around our assumptions—for example, it’s unclear whether the propensity to spend out of crypto holdings will ultimately be larger or smaller than for equities and other asset classes—our results strongly suggest that the crypto impact will be marginal relative to other factors.”

The bank added that the impact on the US labor force participation rate should also be muted given that the participation of young men in the labor force — “the demographic group that is the most likely to be affected by the crypto pullback” — is currently at pre-pandemic levels.