The Central Bank of Sudan (CBoS) has put out a message, warning its citizens about trading all forms of cryptocurrency, according to a report by the state’s official news outlet, Sudan News Agency (SUNA).

The country’s Apex bank stated cryptocurrencies are not issued by a recognized or accredited authority; hence they are vulnerable to financial crimes, digital piracy, and a high level of volatility in value. The Central Bank of Sudan(CBoS) also emphasized the legal risks involved, as cryptocurrencies according to the county laws, are not regarded as money, private money, or property.

Interestingly, the Northeastern African country is not the only African nation to express concerns over cryptocurrency. Out of 51 countries that have placed a ban on cryptocurrencies, 23 are African countries per a report by the United States’ Library of Congress(LoC). This LoC report, however, is somewhat contradicted by a Brookings Institution report that ranks Africa as the fastest-growing cryptocurrency market.

According to Chainalysis, Africa’s crypto market received an influx of $105.6 billion between July 2020 to June 2021. Nevertheless, 4 African countries namely Algeria, Morocco, Tunisia, and Egypt have implemented an absolute ban on dealing in crypto. Meanwhile, 19 countries including Nigeria, the most populous black nation, and Africa’s largest economy have placed a rather tacit ban on cryptocurrency.

On February 5, 2021, the Central bank of Nigeria, released a circular prohibiting all banking institutions from dealing in cryptocurrency or enabling payments for cryptocurrency transactions. However, Nigerians are still allowed to own crypto assets.

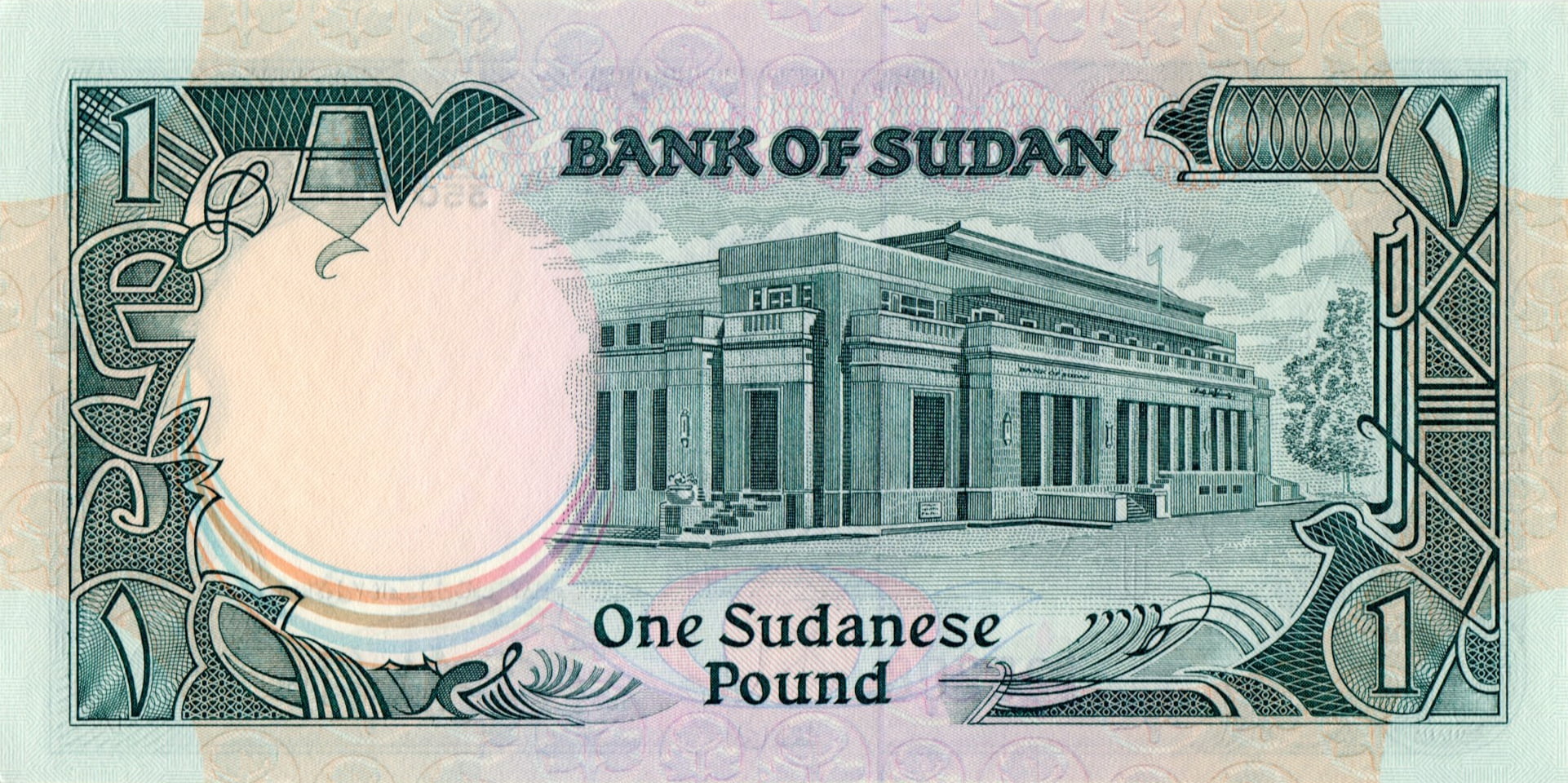

The warning on cryptocurrency by Sudan’s apex bank comes as the country’s currency, the Sudanese pound is experiencing a drastic loss in value, following a coup last October. The forceful removal of a democratically elected government led to a withdrawal of international economic support from the country.

As a result, there has been a high demand for a rather low supply of U.S dollars, leading to the Sudanese pound losing more than a third of its value. Consequently, there have been unfavourable increases in the price of food and other commodities.

In this month of March, the Bank of Sudan has had to devalue its currency twice to keep the economy afloat and one U.S dollar currently is equal to 447 Sudanese pounds. It is this dire economic situation that has made saving in cryptocurrency more attractive to Sudanese citizens.