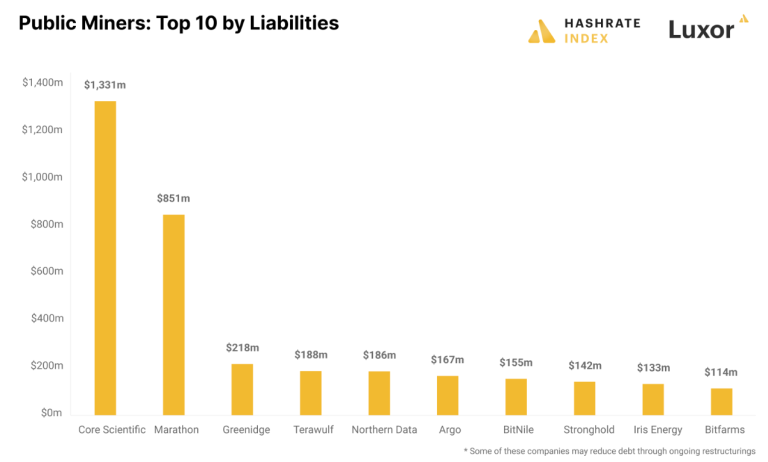

The mining industry for Bitcoins incurred a sizeable debt load during the bull market of 2021, which hurt their financial health during the subsequent bear market. The top 10 cryptocurrency mining debtors together owe more than $2.6 billion, according to predictive analytics by Hashrate Index.

Due to declining sales and BTC prices, Core Scientific, the largest debtor in the group with $1.3 bn in obligations on its income statement as of September 30th, has filed for Chapter 11 insolvency protection in Texas. The majority of convertible note liabilities totalling $851 million belong to Marathon, the second-largest debtor. By enabling the debtors to exchange the convertible notes for stock, Marathon avoids bankruptcy.

To pay off debt, the majority of Bitcoin miners, including Greenidge, the third-largest debtor, are undergoing a restructuring process. The debt-to-equity relation of publicly traded bitcoin mining businesses suggests a substantial risk for the sector.

The Combined Debt of Public Bitcoin Mining Firms is $4 Billion

According to the Hashrate Index, most sectors see a debt-to-equity proportion of 2 or greater as dangerous. The graph below demonstrates the unusually high debt-to-equity ratios that some of the more well-known Bitcoin miners presently wear. The mining industry may experience possible restructurings as well as bankruptcy proceedings unless the bulls stage a return, given that more than 50% of the 25 publicly traded bitcoin miners flaunt exceptionally high debt-to-equity ratios.

While some businesses may halt or scale back operations to cut costs, this will enable sustainable miners to increase their footprint by purchasing the facilities and equipment of rival enterprises.

On December 20, Greenidge and the Bitcoin-focused financial company NYDIG agreed to restructure $74 million in debt.

2.8 exahashes per second (EH/s) or more worth of mining capacity would be acquired under the terms of the NYDIG agreement, according to Cointelegraph. The mining corporation would get a debt reduction ranging from $57M to $68M in return.

More information on Bitcoin Mining

比特币是第一个去中心化的数字货币,它使用底层区块链技术来允许点对点转账,而无需使用银行、组织、代理商或经纪人等任何中间人。 无论身在何处,网络上的任何人都可以将比特币发送给网络上的其他用户; 他们所需要做的就是在网络上创建一个配置文件,存入一些比特币,然后他们就可以发送比特币。

在“挖掘”比特币的过程中,使用运行比特币代码的全球计算机网络来验证付款并将其正确上传到区块链网络。 采矿过程还会产生新的比特币。

通过挖掘比特币,这涉及将新交易与比特币网络进行比较,从而创建新的硬币。 在区块链上参与和电子验证比特币交易的过程称为“挖矿”。 必须解决困难的加密哈希问题,以验证去中心化区块链分类账上已更改的交易块。 解决这些难题所需的工具和处理能力都是尖端的