Der Kryptomarkt hat an Schwung verloren, da der Preis von Bitcoin (BTC), Ethereum (ETH) und Binance Coin (BNB) beginnt, im Minus zu handeln. Die nach Marktkapitalisierung größten Kryptowährungen könnten weitere Verluste erleiden, da makroökonomische Faktoren weiterhin einen negativen Einfluss auf risikobehaftete Vermögenswerte ausüben.

Zum Zeitpunkt der Abfassung dieses Artikels liegt die Krypto-Gesamtmarktkapitalisierung bei 1,09 Billionen US-Dollar, nachdem sie bei der Marke von 1,2 Billionen US-Dollar abgelehnt wurde. Dies hat zu geringfügigen Verlusten bei Bitcoin (2,2 %) und Binance Coin (7 %) geführt, nur Ethereum konnte einen Teil seiner Gewinne der letzten Woche halten.

Analyst Justin Bennett glaubt, dass der Kryptomarkt durch den Aufwärtstrend des US-Dollars negativ beeinflusst wurde. Die Währung erlebte zu Beginn des Jahres 2022 auf ihrem Monats-Chart einen großen Schub nach oben und scheint zu versuchen, das Niveau von 2022 in höheren Zeiträumen zurückzuerobern.

Dies könnte zu weiteren Verlusten bei risikobehafteten Vermögenswerten wie Aktien und Kryptowährungen führen; mehr wirtschaftliche Unsicherheit, da die Inflation seit Jahrzehnten höher tendiert; weniger Liquidität auf den globalen Finanzmärkten. Bennett sagte Folgendes, während er das Diagramm unten teilte:

Erwarten Sie, dass #Aktien und Krypto zu kämpfen haben, während der US-Dollar dies tut. Der $DXY hat gerade 107 auf seinem Weg zu 107,40 herausgeholt. Ich denke immer noch, dass wir 112-113 sehen. Sei vorsichtig da draußen (…). Der Trend ist dein Freund … es sei denn, es ist der $DXY. 112-113 zuerst, aber höchstwahrscheinlich 120 in den nächsten Monaten. Ein Anstieg des USD bedeutet einen Rückgang der Risikoanlagen.

Analyst Justin Bennett glaubt, dass der Kryptomarkt durch den Aufwärtstrend des US-Dollars negativ beeinflusst wurde. Die Währung erlebte zu Beginn des Jahres 2022 auf ihrem Monats-Chart einen großen Schub nach oben und scheint zu versuchen, das Niveau von 2022 in höheren Zeiträumen zurückzuerobern.

Dies könnte zu weiteren Verlusten bei risikobehafteten Vermögenswerten wie Aktien und Kryptowährungen führen; mehr wirtschaftliche Unsicherheit, da die Inflation seit Jahrzehnten höher tendiert; weniger Liquidität auf den globalen Finanzmärkten. Bennett sagte Folgendes, während er das Diagramm unten teilte:

Erwarten Sie, dass #Aktien und Krypto zu kämpfen haben, während der US-Dollar dies tut. Der $DXY hat gerade 107 auf seinem Weg zu 107,40 herausgeholt. Ich denke immer noch, dass wir 112-113 sehen. Sei vorsichtig da draußen (…). Der Trend ist dein Freund … es sei denn, es ist der $DXY. 112-113 zuerst, aber höchstwahrscheinlich 120 in den nächsten Monaten. Ein Anstieg des USD bedeutet einen Rückgang der Risikoanlagen.

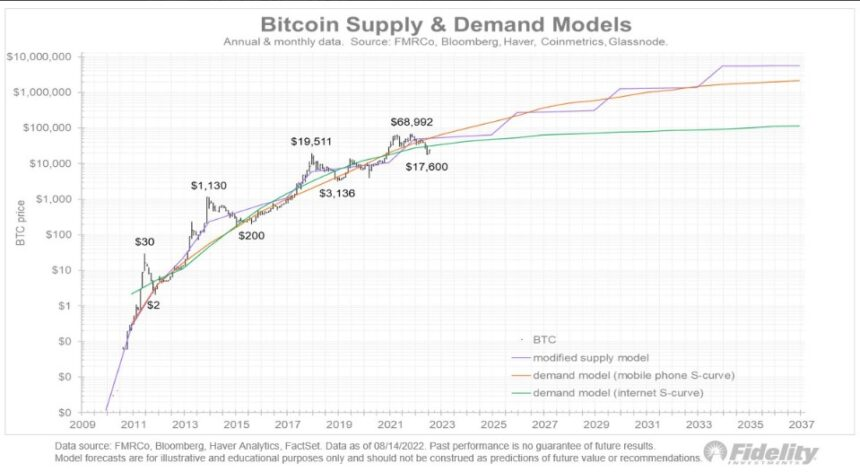

Die größte Kryptowährung nach Marktkapitalisierung, Bitcoin, verzeichnete mit rund 17.600 $ ein Jahrestief. Wie NewsBTC berichtete, ist Jurrien Timmer, Director of Macro bei Fidelity, der Ansicht, dass dieses Niveau mit den früheren Tiefstständen der Kryptowährung vergleichbar ist, und erwartet, dass dieser Preispunkt als entscheidende Unterstützung dienen wird.

Werden makroökonomische Faktoren eine kritische Unterstützung für Krypto brechen?

Unter Verwendung der Angebots- und Nachfragemodelle von BTC verglich Timmer 17.600 $ mit 3.100 $ und 200 $, zwei wichtige Unterstützungszonen für Bitcoin selbst bei anhaltenden Abwärtstrends. Der Experte sagte Folgendes über die Fähigkeit von BTC, langfristig mehr Wertschätzung zu sehen, ein zinsbullisches Momentum, das sicherlich den gesamten Kryptomarkt nach oben treiben wird:

Das Preis-Netzwerk-Verhältnis von Bitcoin (mein Stellvertreter für ein Bewertungsmultiplikator) liegt wieder auf dem Niveau von 2014. Unterdessen wächst sein Netzwerk weiter, ungefähr entlang einer Leistungsregressionskurve.

Im Gegensatz dazu erwartet Bennett weitere Verluste für den Preis von BTC und den Kryptomarkt. Die erste Krypto nach Marktkapitalisierung könnte zwischen 9.500 und 13.500 $ liegen.

Die Baisse-These des Experten basiert auf der aktuellen Geldpolitik der US-Notenbank (Fed). Bennett glaubt, dass das Finanzinstitut fest entschlossen ist, die Inflation zu stoppen und die Zinssätze weiter erhöhen wird, um dieses Ziel zu erreichen.