يخضع حاليًا لعملية بيع خاصة لرمزه المميز ، مع إطلاق عام لمتابعة.

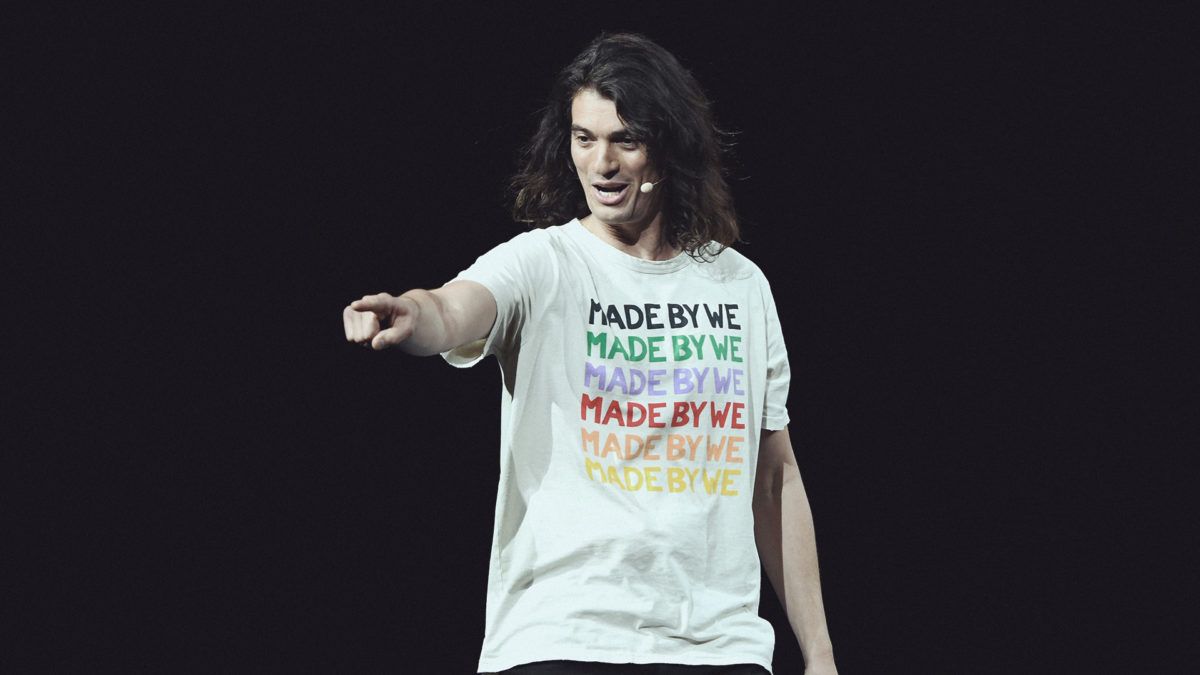

جمعت Flowcarbon ، وهي شركة ناشئة شارك في تأسيسها آدم نيومان ، الرئيس التنفيذي السابق لشركة WeWork ، 70 مليون دولار لتطوير أدوات تداول الكربون القائمة على blockchain.

قادت الجولة ، التي تضمنت كلاً من تمويل رأس المال الاستثماري وبيع الرموز ، وحدة التشفير في Andreessen Horowitz ، وفقًا لبيان صدر يوم الثلاثاء. ومن بين المستثمرين الآخرين جنرال كاتاليست وسامسونغ نيكست و 166 سكند وسام وآشلي ليفينسون و RSE Ventures و Allegory Labs. من بين المشاركين في بيع التوكن: Fifth Wall و Box Group و Celo Foundation.

"مهمة Flowcarbon هي دفع مليارات الدولارات مباشرة إلى المشاريع التي تقلل أو تزيل الكربون من الغلاف الجوي من خلال إنشاء أول بروتوكول مفتوح لترميز أرصدة الكربون الحية المعتمدة من المشاريع في جميع أنحاء العالم ،" قالت الشركة التي تتخذ من نيويورك مقراً لها في الإصدار . "من خلال بروتوكول Flowcarbon ، يمكن لمطوري المشروع الوصول فورًا إلى سوق للمشترين المهتمين بائتماناتهم من خلال جلبهم إلى blockchain. يمكن للمشترين بعد ذلك شراء أرصدة الكربون الحية مباشرة من مؤيدي المشروع ".

أطلقت Flowcarbon رمز Goddess Nature Token (GNT) ، وهو رمز تشفير على سلسلة Celo blockchain مدعومة بأرصدة الكربون. يمكن استبعاد الرموز المميزة كتعويض أو بيعها أو استخدامها للاقتراض والإقراض أو استردادها مقابل ائتمان أساسي حقيقي ، وفقًا لـ Flowcarbon.

من إجمالي الأموال التي تم جمعها ، جاء 32 مليون دولار من شركات رأس المال الاستثماري و 38 مليون دولار من بيع جي إن تي ، وفقًا لرويترز.

ينتهي البيع الخاص لـ GNT في غضون يومين ، وفقًا لموقع الشركة على الويب ، والذي يسمح أيضًا للأشخاص بالتسجيل في الإطلاق العام الوشيك للرمز المميز.

شارك في تأسيس Flowcarbon آدم نيومان وزوجته ريبيكا نيومان ودانا جيببر وكارولين كلات وإيلان ستيرن. يعمل في الشركة 35 موظفًا ، يعمل جيببر كرئيس تنفيذي.